When you work with our CERTIFIED FINANCIAL PLANNERS™, we help you stand out from the statistics.

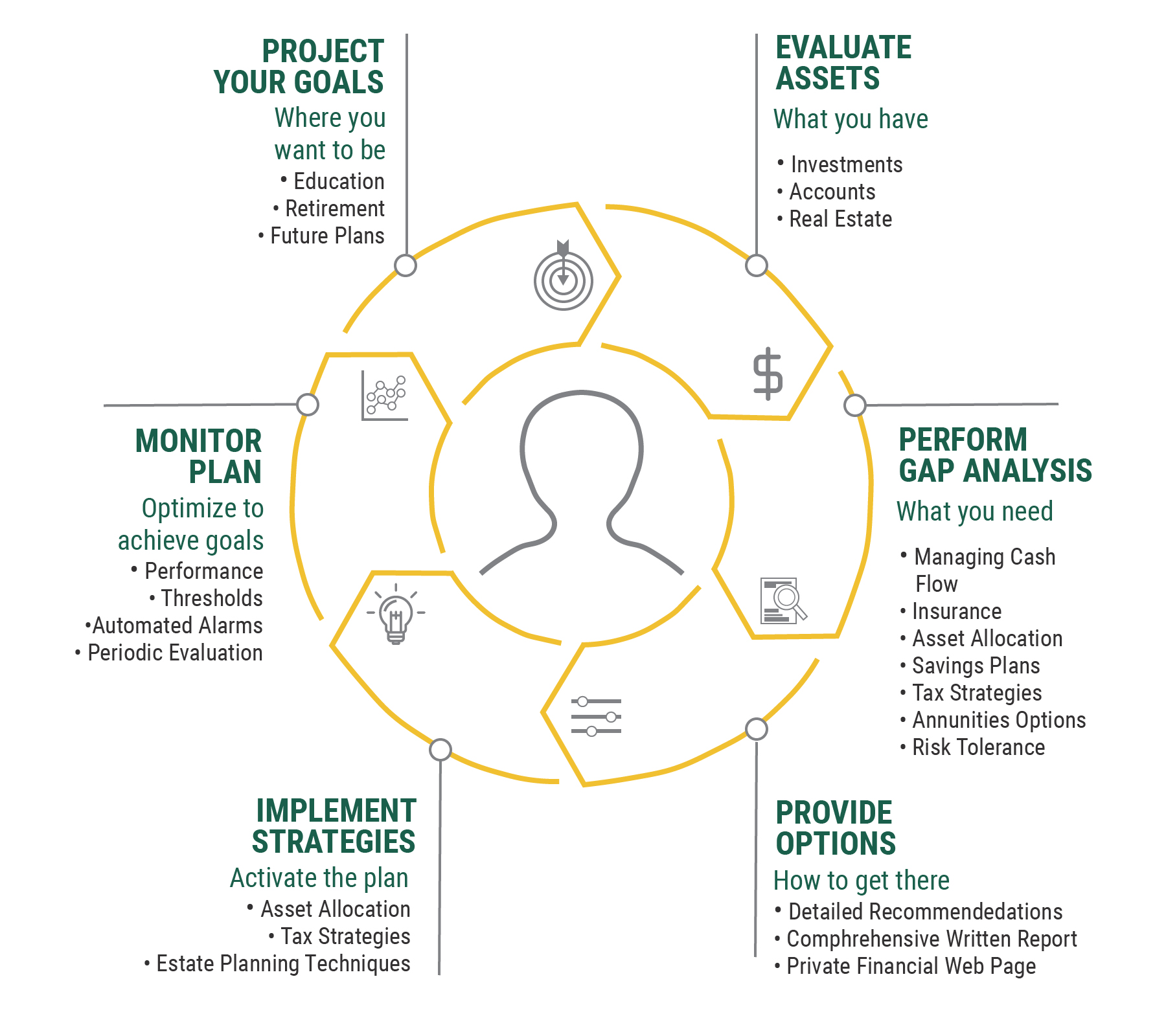

Those who plan, succeed. Our process is intentionally designed to help you get from point A to Z and all the other points in between.

PROFESSIONALS

PROFESSIONALS

We want to make this simple for you, period. Log on to your personal wealth center app on any device to keep track of all your finances, in one spot, any time.

Starting a Career:

Your on your own now, work with us to reduce college debt, build your credit, and start your savings plan.

Starting a Family:

With a bigger family comes more complexity. Make sure your family's protected, start saving for college, manage a budget and keep cash-flow positive.

Mid Career:

Your highest earning year, have you defined your future goals, are you on track for retirement?

Empty Nesters:

Spend a few years on your own before retirement, let's make sure we are staying on track while having a little more time.

Preparing for Retirement:

Are you on track, is your budget in line with your goals, are you ready to stop earning income?

In Retirement:

Let's make sure your assets will last for the rest of your life.

Preparing for a Wealth Transfer:

Helping you make sure estate plan in line with your wishes.

Are your goals to retire early? If so, let's figure out your spend goal and where your income is going to comes from for the next 30 years.